Demystifying Grid Trading: A Roadmap for Navigating Volatile Crypto Markets

Unlocking Grid Trading Insights

Grid trading is a dynamic and systematic successful grid trading strategy, tailor-made to thrive in a variety of market conditions, from the roller-coaster rides of bull markets to the more tranquil sideways drifts. As we delve into this automated grid trading strategy, you'll discover how to master this approach and its potential to become a no loss grid trading strategy in the realm of crypto.The Inner Workings of Grid Trading

At its core, grid trading hinges on the creation of multiple

predetermined price levels. These price levels act as triggers, executing buy

or sell orders as the market price aligns with them. This level of precision is

essential for a successful grid trading strategy, as we'll see in our grid

trading example.

The Power of Automation

One of the defining features of grid trading is its

systematic nature, reducing the need for human intervention. The only manual

input required is the initial setup of these predetermined price levels. Once

established, crypto grid trading bots, readily available on crypto trading

platforms, take the reins, allowing traders to sit back and watch their

strategies unfold effortlessly.

Key Insights

Grid Configuration for a Successful Grid Trading Strategy

Grid trading involves configuring predetermined prices for

both buying and selling, with automatic execution as prices align. This feature

is at the heart of a no loss grid trading strategy.

Adaptability for Crypto Grid Trading

This strategy is incredibly versatile, adapting seamlessly

to various crypto market scenarios, whether they're trending or stuck in

sideways motion.

Battle-Tested in Forex and Crypto

Grid trading isn't a newcomer to the trading scene. It

boasts a rich history in forex trading, the world's largest financial market

with unmatched trading volume. This extensive experience underscores its

reliability as a battle-tested trading strategy, whether in forex or crypto

markets.

A Deeper Dive into Grid Trading

Sideways Market Approach

In a sideways market, traders begin by selecting a reference

price. For example, when dealing with a sideways market, buy orders are placed

below this reference price. Each buy order corresponds to a sell order set at

levels (typically two levels) above the buy orders. These price levels form a

grid-like pattern, hence the name "grid trading." The distance

between each price level is typically uniform. Traders also establish a maximum

price level for sell orders and a minimum price level for buy orders.

Uptrending Markets

In an uptrending market, buy orders are set above the

reference price. Each buy order pairs with a corresponding sell order set

slightly above (usually one level) the buy orders. Additionally, traders set a

maximum price level to ensure buy orders aren't executed at or above that

threshold.

Downtrending Markets

For a downtrending market, short-sell orders are placed

below the reference price. Each short-sell order has a corresponding order to

close the short-sell position, set slightly below (typically one level) the

short-sell orders. Similar to other scenarios, traders also set a minimum price

level to prevent short-sell orders from executing below that threshold.

Customization is Key

These examples provide a general overview of how grid

trading strategies typically function. However, it's essential to note that

traders can tailor their configurations based on personal preferences. Grid

trading tools, including Grid Trading Bots offered by various crypto trading

platforms, offer flexibility in applying grid trading strategies.

Advantages of Grid Trading

Simplicity in Application

Grid trading is refreshingly straightforward, requiring only

price input. Unlike fundamental analysis, which delves deep into sector

dynamics, valuations, and more, grid trading relies on price movements. Once

the initial price levels are set, the strategy operates autonomously,

eliminating the need for constant market monitoring.

Customization Galore

Users have the freedom to set as many or as few price levels

in the grid as they wish, catering to individual preferences and circumstances.

Grid trading can also be seamlessly integrated with other strategies, such as

technical analysis, allowing users to combine knowledge of technical support,

resistance levels, and trend lines with grid trading.

All-Weather Performance

Grid trading is adaptable, suitable for diverse market

environments, whether trending or sideways. However, users should remain

vigilant, as markets can change rapidly and unexpectedly. Employing riskmanagement tactics alongside the grid trading strategy is advisable.

Battle-Tested in Forex and Crypto

Grid trading has a robust track record in forex markets, the

world's largest financial arena with a staggering daily trading volume of

US$6.6 trillion. This impressive pedigree makes grid trading a viable strategy

for crypto market enthusiasts.

Overcoming Emotional Biases

Feelings have the potential to obscure rational thinking and

result in less-than-optimal trading choices. Grid trading's systematic approach

removes human judgment and emotion from the equation. This is particularly

beneficial in countering cognitive biases commonly observed among investors,

including herd behavior, confirmation bias, loss aversion, recency bias, and

anchoring bias.

Strengthening Your Grid

To optimize grid trading, consider implementing risk

management strategies such as stop-losses, hedge grid trading, and position

sizing.

Stop-Losses for a Successful Grid Trading Strategy

In situations where market behavior deviates from the grid's

initial setup, stop-losses come to the rescue. These automatic sell triggers

activate when a predetermined loss threshold is reached, helping minimize or

control potential losses.

Hedge Grid Trading for Crypto Grid Trading

Hedge grid trading involves placing both long and short-sell

orders within the same grid. This approach allows the strategy to potentially

profit regardless of whether prices rise or fall. For instance, in a declining market,

profits from short positions may offset losses from long positions, resulting

in an overall gain.

Position Sizing for a No Loss Grid Trading Strategy

Properly sizing positions can protect a trader's overall

portfolio, even if individual positions incur losses. A simple method is to

ensure that each trade represents only a small percentage of the total

portfolio, thereby spreading risk.

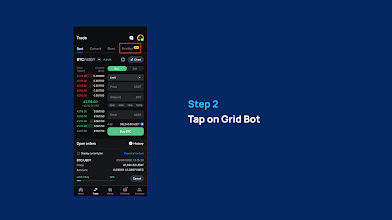

How to Create a Grid Trading Bot on XREX

The Ultimate Trading Tool for All

Follow our step-by-step guide to master the creation of

your first Grid bot on XREX.

Step 01 :

Step 04 :

XREX Exchange has introduced the Grid bot, an innovative trading feature designed for both novice and experienced traders. This feature streamlines the process of buying and selling cryptocurrencies at predetermined levels, capitalizing on price fluctuations to secure consistent profits.

To get started, set your preferred parameters, and let the

intelligent Grid bot take the reins, trading for you 24/7. This hands-off

approach allows you to focus on other aspects of life without the stress of

continuous market monitoring.

Grid bot trading carries inherent risks. As always, manage

your risk prudently.

Activate notifications on the XREX app to receive timely

updates.

Choose between creating a Grid bot manually or using the

Smart bot. The Smart bot recommends parameters based on 21 days of backtesting,

while manual setup provides a more customized approach with various options,

including grid modes, start/close triggers, grid sizes, and more.

Fees

Currently, XREX grid trading is available for BTC/USDT and

ETH/USDT trading pairs, with a modest trading fee of 0.05%. These low

transaction fees ensure efficient execution of trading strategies.

FAQ

Is grid trading strategy profitable?

Grid trading can be profitable when executed correctly, but

it's essential to understand its principles and risks.

What is the disadvantage of grid trading?

One disadvantage is the potential for losses if the market

doesn't behave as expected, especially during strong trends.

What is take profit in grid trading?

Take profit in grid trading refers to the predefined price

level at which a portion or all of the position is closed to secure profits.

Which crypto is best for grid trading?

The suitability of cryptocurrencies for grid trading varies.

Bitcoin (BTC) and Ethereum (ETH) are popular choices, but the best crypto for

grid trading depends on market conditions and personal preferences.

Disclaimer:

The examples provided in this article serve informational purposes only. They should not be interpreted as legal, tax, investment, financial, or cybersecurity advice. A2ZCrypto does not endorse, recommend, or solicit the buying, selling, or investment in any coins, tokens, or crypto assets. Crypto asset trading may be subject to tax regulations, including capital gains tax, in your jurisdiction.